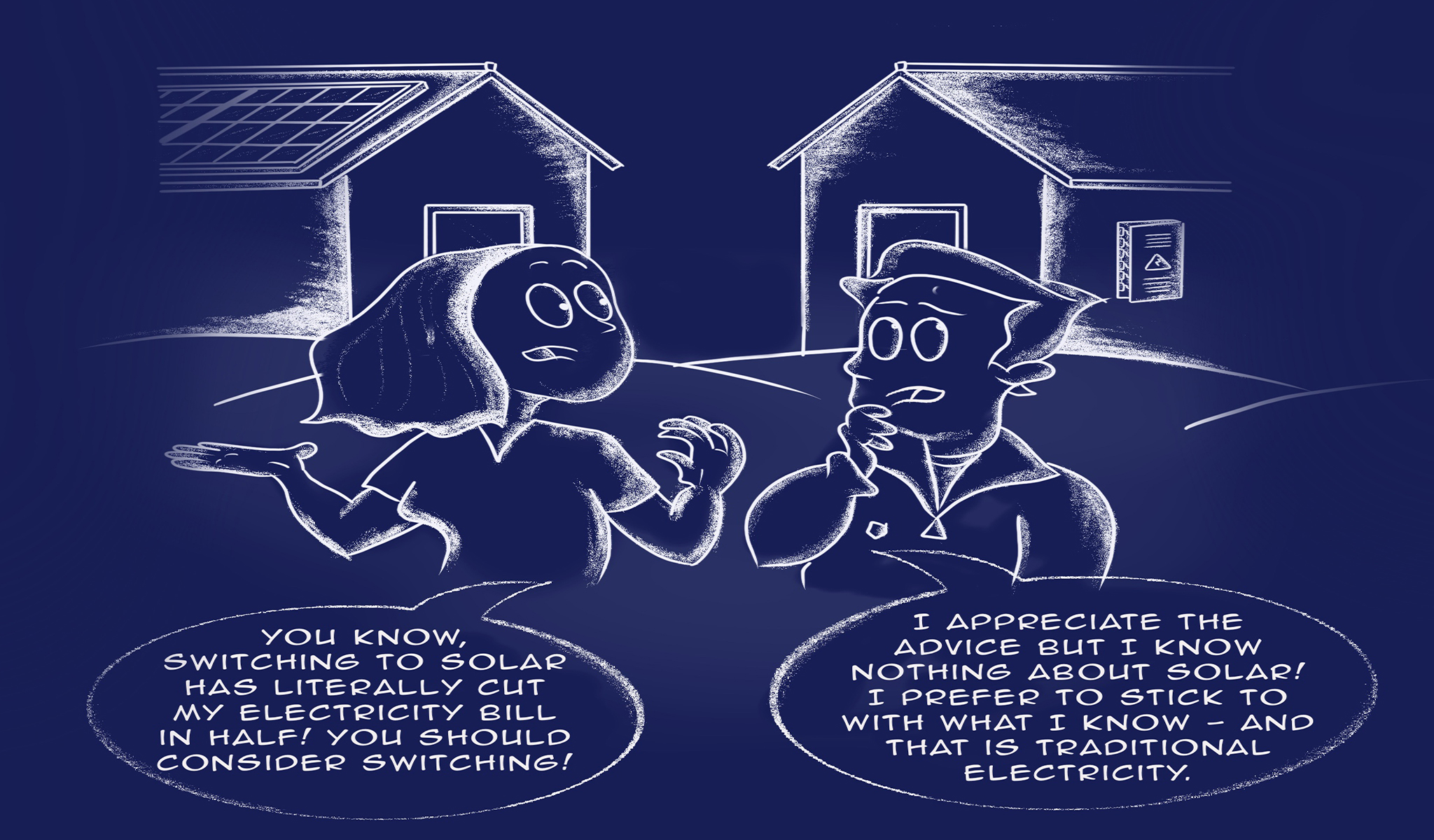

Ambiguity aversion is a cognitive bias that occurs when individuals prefer known risks over unknown risks, even if the unknown risks have the potential for better outcomes. People tend to gravitate toward situations where the probabilities and outcomes are clear, avoiding situations with uncertainty or ambiguity.

Explanations:

Ambiguity aversion is linked to the human desire for predictability and aversion to the anxiety that uncertainty can generate. People often choose familiar risks because they can more easily assess and understand them.

Examples:

Investment Choices: Investors may prefer traditional, well-understood investment options over newer, more uncertain opportunities with greater potential returns.

Medical Decisions: Patients may choose well-known medical treatments with established outcomes over experimental treatments that carry some level of uncertainty.

Career Decisions: Individuals might opt for a stable but unfulfilling job over pursuing a passion or entrepreneurial venture with an unclear path to success.

Solutions:

Risk Assessment: Develop the ability to assess and quantify uncertain situations more effectively.

Risk Tolerance Evaluation: Evaluate and understand your own risk tolerance to make more informed choices that align with your preferences.

Education: Educate yourself about uncertain situations and potential risks to make better decisions in ambiguous circumstances.

Coping with Uncertainty: Build coping strategies for dealing with uncertainty, such as learning to manage anxiety related to ambiguous situations.

Addressing ambiguity aversion involves recognizing the inclination to prefer known risks over unknown risks and actively promoting risk assessment, risk tolerance evaluation, education, and coping strategies for dealing with uncertainty to make more balanced and informed decisions.