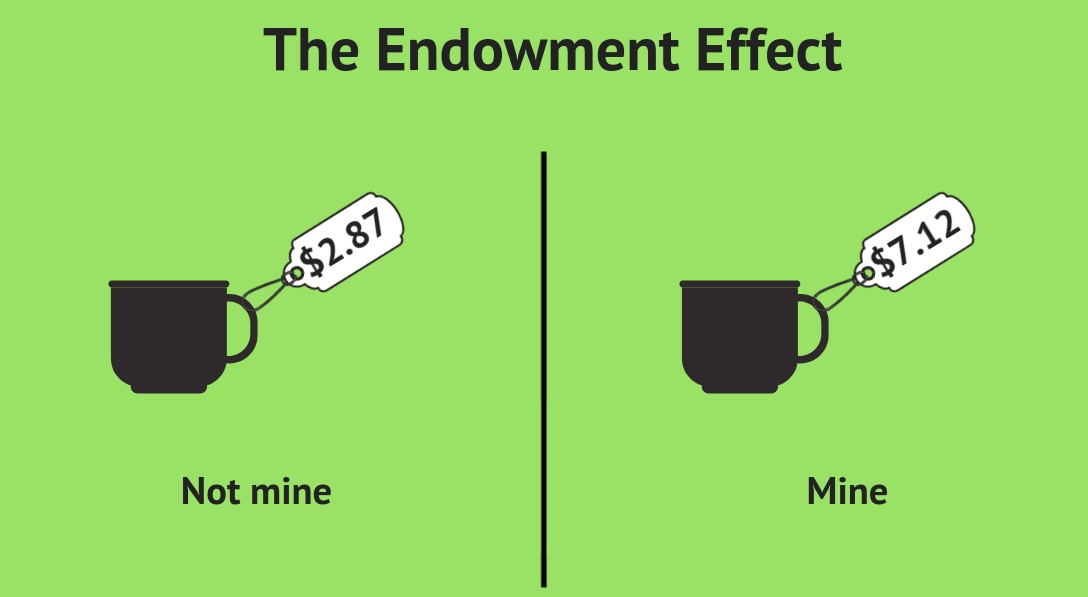

The endowment effect is a cognitive bias that leads people to assign a higher value to the things they own or possess than they would to the same items if they did not own them. In other words, people often overvalue their possessions, considering them to be more valuable or desirable simply because they own them.

Explanations:

The endowment effect is linked to the concept of loss aversion. Possessions are seen as part of one’s identity, and the potential loss of these items can trigger emotional reactions, leading people to perceive them as more valuable.

Examples:

Personal Items: If you own a vintage guitar, you might believe it’s worth more than its market value because of your emotional attachment to it.

Real Estate: Homeowners may overestimate the value of their own properties compared to what a potential buyer would be willing to pay for them.

Stock Holdings: Investors may be hesitant to sell their stocks, even when it’s financially rational, because they believe the stocks are inherently more valuable due to their ownership.

Solutions:

Objectivity: When evaluating the value of possessions, strive to be objective. Consider market prices, appraisals, or expert opinions rather than solely relying on your emotional attachment.

Diversify Assets: Diversify your investments and possessions. Owning a range of assets can help reduce the endowment effect’s impact on your decision-making.

Emotional Awareness: Be aware of the emotional factors influencing your attachment to possessions. Understanding your biases can help you make more rational decisions.

Use the “Would I Buy It” Test: If you were presented with the option to buy the same item you own today, would you do it at its current market price? This can help you gauge its actual value.

By addressing the endowment effect, individuals can make more rational decisions about their possessions, investments, and assets, considering actual market value rather than emotional attachment.